Personal Income Tax Updates

In the latest budget announcement, significant changes have been made to personal income tax regulations aimed at providing relief to taxpayers. Here’s a breakdown of the key updates:

- Increased Rebate Limit: The rebate limit in the new tax regime has been raised to ₹ 7 lakh. This means individuals under the new tax regime earning up to ₹ 7 lakh will be exempt from paying any taxes, offering substantial relief.

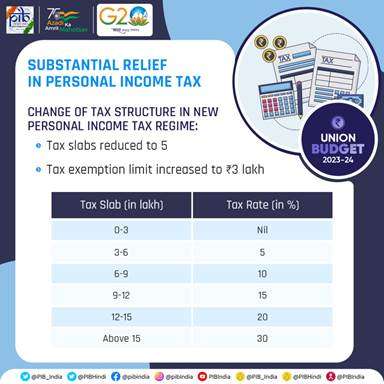

- Restructured Tax Slabs: The tax structure in the new personal tax regime has been simplified with the number of slabs reduced to five. Additionally, the tax exemption limit has been raised to ₹ 3 lakh, providing considerable relief to taxpayers.

- Standard Deduction Extension: The benefit of standard deduction has been extended to the salaried class and pensioners under the new tax regime. Salaried individuals will now receive a standard deduction of ₹ 50,000, while pensioners will receive ₹ 15,000, easing their tax burden.

- Surcharge Reduction: The highest surcharge rate in personal income tax has been decreased from 37% to 25% for incomes above ₹ 2 crore, resulting in a maximum tax rate of 39%.

- Leave Encashment Exemption: The limit of tax exemption on leave encashment for non-government salaried employees upon retirement has been significantly raised from ₹ 3 lakh to ₹ 25 lakh.

- Default Tax Regime: The new income tax regime has been made the default option, although citizens retain the option to choose the old tax regime if preferred.

Indirect Tax Proposals

Simplified The budget also focuses on simplifying indirect tax structures to reduce compliance burdens and enhance administration efficiency:

- Customs Duty Reduction: The number of basic customs duty rates on goods, excluding textiles and agriculture, has been reduced from 21 to 13, streamlining the system.

- Excise Duty Exemption: To prevent tax cascading, excise duty on blended compressed natural gas containing GST-paid compressed bio-gas has been exempted.

- Customs Duty Relief: Customs duty exemptions have been extended to import capital goods and machinery required for manufacturing lithium-ion cells for electric vehicles.

- Promoting Domestic Manufacturing: Customs duty relief has been provided on certain parts and inputs for mobile phones and electrical kitchen chimneys to encourage domestic production.

- Miscellaneous Changes: Various changes in basic customs duties have been proposed for items like toys, automobiles, and chemicals to align with policy objectives.

Enhancing Taxpayer Convenience and Compliance In addition to tax amendments, the budget introduces measures to improve taxpayer convenience and compliance:

- Next-Generation IT Return Form: A new common IT return form will be rolled out for taxpayer convenience, alongside plans to strengthen the grievance redressal mechanism for direct taxes.

- Targeted Tax Concessions: To better target tax concessions and exemptions, deductions from capital gains on investment in residential houses and high-value insurance policies will be capped.

- MSME and Cooperative Sector Support: Enhanced presumptive taxation limits for MSMEs, deductions for timely payments to MSMEs, and tax rate benefits for new cooperatives are among the measures proposed to support these sectors.

- Start-up Benefits: The budget extends income tax benefits and loss carry-forward provisions for start-ups to promote entrepreneurship.

- GST Act Amendments: Amendments to the CGST Act aim to raise the minimum threshold for launching prosecutions under GST and reduce compounding amounts for certain offenses, fostering a more conducive tax environment.

Revenue Implications While these proposals are expected to forego around ₹ 38,000 crore in revenue, additional mobilization of about ₹ 3,000 crore is anticipated. Overall, the net revenue foregone due to these proposals is estimated at approximately ₹ 35,000 crore annually.

These updates signify a concerted effort to streamline tax structures, enhance compliance, and provide relief to taxpayers, thereby fostering a more efficient and equitable tax regime.

For More Information kindly refer our website http://www.filingpool.in