GSTN enables new function for calculation of annual aggregate turnover (AATO) for taxpayers/registered person. In this new function it calculate’s aggregate turnover of registered person.

This new function has been deployed on taxpayer’s/ registered person dashboard.

Taxpayers/ Registered person can now see there annual aggregate turnover (AATO) for the previous financial year or current financial year.

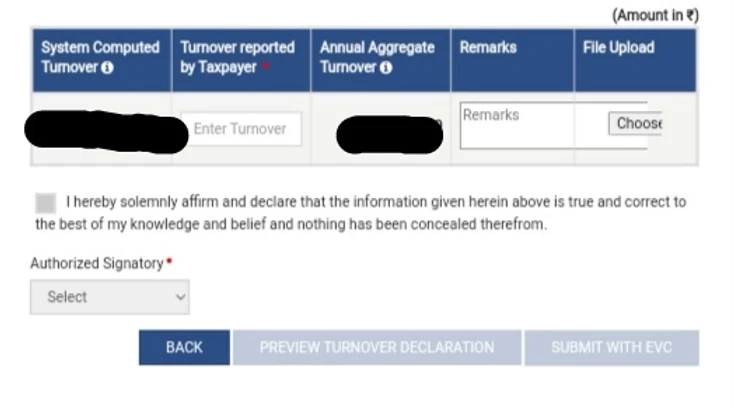

If Taxpayer/Registered person found any descripency with system calculated turnover vis a vis with their records then they can file or update turnover details on GST website, in simple words if Taxpayer/Registered person annual aggregate turnover (AATO) does not matched with thier records then they can file or update turnover details on GST website.

This facility has been provided on PAN India basis. All the changes by any of the GSTIN’s in their turnover shall be summed up for computation of annual aggregate turnover for each of the GSTIN’s.

For more details Registered person/ Taxpayer may see their respective dashboards.

#GST #AATO #GSTN #GSTIN #Aggregateannualturnover