For most salaried individuals, income tax return filing feels like a once-a-year formality. You receive Form 16, upload a few numbers, click submit, and move on. What this mindset misses is that your ITR is not just a tax document. It is a financial identity record that affects your loans, visas, investments, refunds, and even future tax scrutiny.

Whether you are a private employee, government staff, consultant on payroll, or someone earning salary along with interest or side income, filing your ITR correctly matters far more than simply filing it on time. A salaried person’s return looks simple on the surface, but errors usually happen in exemptions, regime selection, interest income reporting, and mismatch with AIS and Form 26AS.

Who Is Considered a Salaried Person for ITR Purposes?

A salaried taxpayer is anyone receiving income under the head “Income from Salary” as defined by the Income Tax Act. This includes fixed salary, bonuses, allowances, commissions, arrears, and perquisites provided by the employer.

You are treated as a salaried individual even if:

- You have switched jobs during the year

- You receive salary from multiple employers

- You earn pension income

- You have additional income like bank interest or rent

Salary income does not mean your ITR is limited to salary alone. The moment you earn interest, capital gains, or rental income, your filing complexity changes.

Why Filing ITR Is Important Even If No Tax Is Payable

Many salaried individuals believe that if TDS is already deducted or income is below the taxable limit, filing an ITR is unnecessary. This assumption creates long-term problems.

Filing ITR establishes a clean financial trail. It shows income consistency, tax compliance, and transparency, all of which are checked during loan approvals, visa processing, and high-value financial transactions.

Key reasons salaried employees should file ITR:

- Proof of income for home loans, personal loans, and credit cards

- Faster processing of refunds for excess TDS

- Mandatory requirement for visa applications and foreign travel

- Carry forward of losses like capital loss

- Avoidance of late fees and notices

Even zero-tax returns add value to your financial profile.

Choosing the Right ITR Form for Salaried Individuals

Selecting the wrong ITR form is one of the most common mistakes made by salaried taxpayers. The form depends not just on salary, but on your total income profile.

Common ITR Forms Used by Salaried Persons

ITR-1 (Sahaj)

Used by salaried individuals with:

- Income up to ₹50 lakh

- Salary or pension income

- Income from one house property

- Other income like bank interest

ITR-2

Required if you have:

- Capital gains from shares, mutual funds, or property

- Income from more than one house property

- Foreign income or assets

- Director or unlisted shareholding status

Once capital gains or foreign assets enter the picture, ITR-1 becomes invalid.

Old Tax Regime vs New Tax Regime: What Salaried Employees Must Evaluate

Choosing the wrong tax regime can cost salaried individuals thousands of rupees every year. The new tax regime offers lower slab rates, but removes most deductions. The old regime allows exemptions but comes with higher rates.

This decision should never be random. It depends on your salary structure and actual investments.

Old Tax Regime Works Better If You Claim:

- House Rent Allowance (HRA)

- Standard deduction

- Section 80C investments (PF, ELSS, LIC, PPF)

- Health insurance under Section 80D

- Home loan interest

New Tax Regime Works Better If:

- You do not invest heavily

- You do not claim HRA or home loan benefits

- Your salary structure has fewer exemptions

Professional comparison before filing ensures you legally pay the least tax.

Common Salary ITR Mistakes That Trigger Notices

Most tax notices sent to salaried individuals are not because of fraud, but because of mismatches. The income tax department now tracks salary, interest, investments, and transactions through AIS and TIS.

Mistakes salaried people often make:

- Not reporting interest from savings and FD accounts

- Ignoring income from previous employer after job switch

- Claiming deductions without proof

- Selecting wrong tax regime

- Mismatch between Form 16 and AIS

A clean review before filing avoids future stress and unnecessary replies.

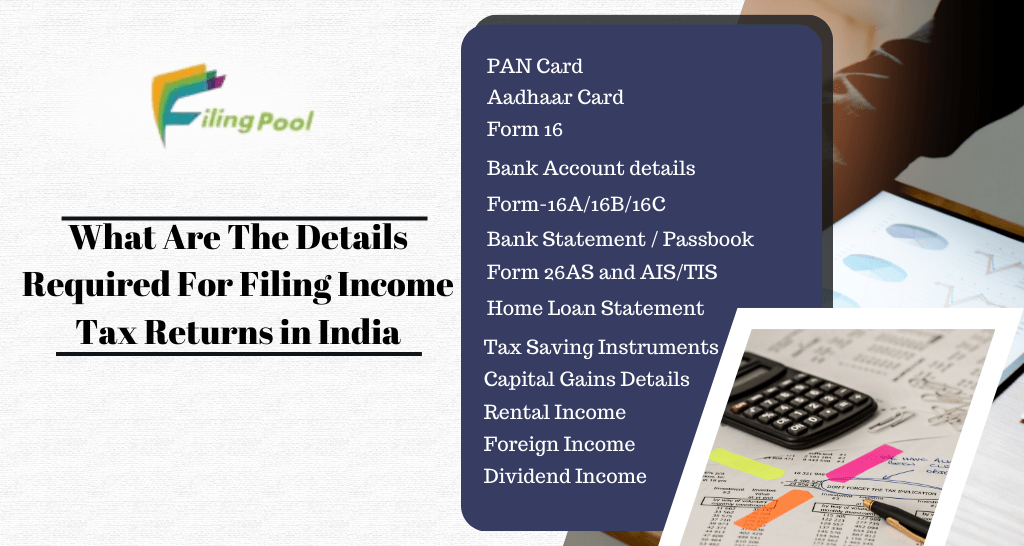

Documents Required for ITR Filing for Salaried Persons

While Form 16 is important, it is not the only document needed. Many deductions and disclosures require additional records.

Essential documents include:

- PAN and Aadhaar

- Form 16 from employer

- Salary slips

- Bank statements and interest certificates

- Investment proofs

- Home loan interest certificate if applicable

- Form 26AS and AIS

Missing even one income source can lead to discrepancies.

Filing ITR on Time: Why Salaried Employees Should Not Delay

Late filing does more damage than most employees realize. Apart from penalties, delayed returns can block refunds and raise compliance risk.

Consequences of late ITR filing:

- Late fee up to ₹5,000

- Loss of interest on refunds

- Inability to carry forward losses

- Increased chance of scrutiny

Early filing also gives you time to revise the return if needed.

How FilingPool Helps Salaried Individuals File ITR Correctly

Salaried individuals often think professional help is unnecessary. In reality, most errors happen in simple returns due to oversight. FilingPool focuses on accuracy, optimization, and compliance, not just submission.

What FilingPool does differently:

- CA review of every salary return

- Old vs new regime comparison before filing

- AIS and Form 26AS reconciliation

- Deduction validation to avoid future notices

- Post-filing support for refunds and notices

Instead of guessing, you file with clarity and confidence.

Final Thoughts: Your Salary ITR Is More Than a Form

For a salaried individual, the income tax return is a financial foundation. It impacts your borrowing power, investment growth, and long-term tax history. Filing it correctly today saves time, money, and stress tomorrow.

If you are a salaried employee looking for accurate, compliant, and optimized ITR filing, professional guidance ensures nothing is missed and everything is aligned with the latest tax rules.