Income Tax Return Filing In Delhi

Introduction

Filing your ITR in Delhi doesn’t have to feel overwhelming. With multiple tax forms, documents to collect, and unpredictability in online filing, many Delhi residents whether salaried professionals, freelancers, property owners, or small business owners face confusion every year. This guide is your practical roadmap to income tax return filing in Delhi, clarifying how to choose the right ITR form (e.g., ITR‑1 vs ITR‑3), ensuring error-free filing and smooth compliance.

At FilingPool, our ITR filing services in Delhi are precisely designed to ease your burden and help you submit accurate returns on time, every time.

Why ITR Filing Matters in Delhi

Filing ITR is not just a formality, it’s a necessary part of your financial life. Benefits include:

- Legal compliance if your income exceeds the exemption limit

- Claiming refunds for excess TDS

- Supporting loans, visas, or tender bids with valid ITRs

- Demonstrating financial credibility, especially for Delhi-based professionals and businesses

- Avoiding penalties or notices for late or incorrect filing

Which ITR is Right for You?

Delhi taxpayers can fall under different ITR categories based on income profile:

- ITR‑1 (Sahaj) for salaried individuals with income up to ₹50 lakh (common for Delhi consultants, executives).

- ITR‑2 if you have capital gains or foreign investments but no business income.

- ITR‑3, if you earn from business, profession, or F&O trading perfect for Delhi freelancers or entrepreneurs.

- ITR‑4 (Sugam) for Delhi small businesses using presumptive taxation (44AD/44ADA/44AE).

How FilingPool helps

Our experts analyze your income streams to determine whether you need ITR‑1 filing in Delhi or ITR‑3 filing in Delhi, minimizing your errors and maximizing deductions.

Are Your Form 26AS and AIS Showing Incorrect TDS?

It’s not uncommon for taxpayers in Delhi to notice mismatches between the income or TDS shown in Form 26AS or AIS and their actual earnings, especially salary, FD interest, or rent. These discrepancies usually occur when employers, banks, or tenants delay TDS payments or fail to report them correctly to the Income Tax Department. Filing your ITR without reconciling this data can result in refund delays, notices from the ITD, or even scrutiny.

Before proceeding with your ITR filing in Delhi, always verify the data in Form 26AS, AIS (Annual Information Statement), and TIS (Taxpayer Information Summary). If there’s a mismatch:

- Submit a Rectification Request using Form 13 if the deductor has deducted excess or incorrect TDS.

- Alternatively, reach out to the deductor (employer, bank, or tenant) and request them to revise their TDS return.

- Avoid filing until your Form 26AS reflects accurate figures this prevents refund rejections or system-generated notices.

At FilingPool, we prioritize data verification and reconciliation for all Delhi-based clients. Our experts ensure your forms match, minimizing the risk of filing errors and post-filing hassles.

Delhi-Specific Filing Issues and How to Avoid Them

Mismatched TDS or Income Statements

Delhi taxpayers frequently report discrepancies between Form 26AS or AIS and actual income. To avoid refund rejection:

- Raise a correction with your employer or deductor (Form 13), or ask for updated statements.

- FilingPool ensures your Form 26AS reconciliation is accurate before filing.

Blending Salary and F&O Gains

A small futures profit, even ₹1, pushes you out of ITR‑1 eligibility. In Delhi, many office-goers trade part-time. To comply:

- Switch to ITR‑3 if you have any business or speculative income.

- Our CA team reviews your financial activity and makes suitable suggestions.

Rental Income and Property Details

If you own property in Delhi and receive rent, it’s critical to:

- Correctly declare income under house property.

- Avoid overstating expenses like municipal taxes.

- FilingPool reviews these details to ensure accurate ITR filing.

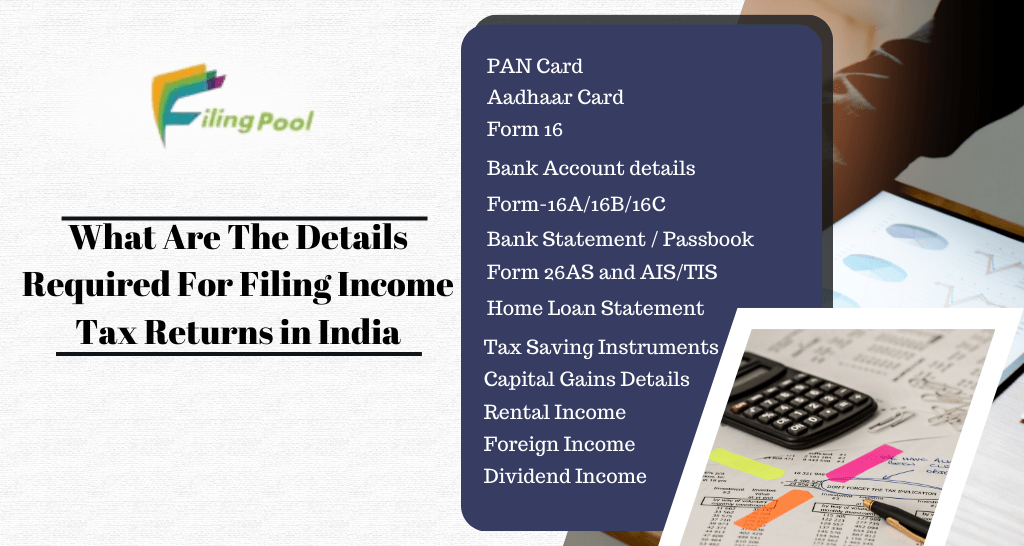

Required Documents for Delhi ITR Filing

Ensure smooth filing by preparing:

- PAN (Aadhaar-linked) and Aadhaar card

- Form 16 and related TDS certificates

- Form 26AS, AIS, TIS statements

- Bank statements, capital gains or rent income proof

- Receipts for investments (80C), insurance (80D), donations (80G)

- Digital copies of Form 11 or Form 2 if nominated

FilingPool Tip: Ensure all documents are ready to complete your ITR filing process in Delhi efficiently.

Filing Your ITR in Delhi: Practical Workflow (Within 24 Hours if Needed)

- Gather documents by morning

- Calculate your tax liability or refund using the ITR utility

- Pay any due tax via net banking before filing

- E‑file using the portal at incometax.gov.in

- Complete e-verification (OTP or Net Banking)

- Monitor acknowledgment email carefully

- We offer concierge-level support throughout the process

Avoid Common ITR Filing Mistakes

- Don’t file ITR before reconciling Form 26AS/AIS

- Avoid selecting ITR‑1 if you have business or capital gains

- Don’t wait until the last minute Delhi portal traffic peaks in June–August

- Avoid errors uploading DS‑certified JSON files

Avoid These 5 Mistakes During Delhi ITR E‑Verification

- Mistyping Aadhaar OTP (often invalid if not updated before midnight).

- Trial of Net Banking e-verify fails due to bank-specific restrictions, especially with Delhi-based banks.

- Using DSC from a previous office WITHOUT proper update of PAN.

- Ignoring post-e-verify email missing final submission confirmation.

- Uploading JSON from third-party software without matching ARNs to pre-fill portal fields.

FilingPool sends you Aadhaar reminders, updates DSC credentials, and confirms all ARN matchups for stress-free e-verification.

Frequently Asked Questions by Delhi Taxpayers

- Can I use any ITR software for Delhi filings?

Yes, but always double-check pincode mapping. FilingPool ensures your ITR reflects the correct residence and tax office. - Is ITR mandatory even if I have no business income?

Yes, if your income exceeds ₹2.5 lakh. Delhi employers and professionals must comply. - Can I claim municipal tax deduction?

Yes, but only if shown under tax ledger. FilingPool reviews this carefully to maximize your benefit.

Why Delhi Taxpayers Trust FilingPool

FilingPool is widely regarded as one of the best CA firms in Delhi for ITR services. Our advantage:

- In-depth understanding of Delhi-specific tax scenarios

- Tailored support whether you’re an individual, freelancer, partnership firm, or NGO

- Streamlined ITR Delhi service, including ITR filing for NGOs in Delhi, ITR filing for partnership firms in Delhi, and ITR filing process support

Call to Action

Ready to get your ITR filed easily and accurately in Delhi? Contact FilingPool whether you’re filing ITR‑1 in Delhi or ITR‑3 in Delhi, our expert team is ready to assist. Skip the hassle and file with confidence.